May 10, 2023

Fixed income

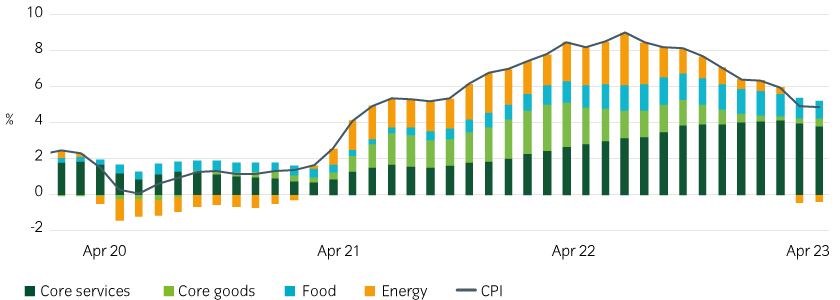

CPI fell slightly to 4.9% year-on-year in April, from 5% in March, to the lowest level in two years. Core CPI ticked down slightly to 5.5% from 5.6%.

The sticky core services inflation segment noticeably slowed, which should offer some relief to the Fed. However, as progress in these categories will likely be slow, we expect the Fed to keep rates elevated in the near term.

Core services show some signs of slowing down

In a break from the recent trend, core goods accelerated while core services inflation slowed (Figure 1).

Figure 1: Energy rebounds after last month’s fall, keeping CPI flat overall

Source: Bureau of Labor Statistics, Bloomberg, May 2023

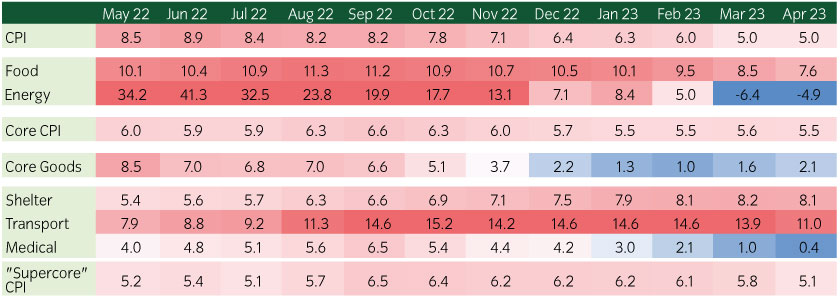

Importantly, the Fed’s closely-watched “supercore” inflation measure (core services excluding housing) reached the lowest level since last July (Figure 2). Elsewhere, the “sticky” shelter inflation category appears to be decelerating, trending at 0.4% month-over-month in April, from 0.6% in March and 0.8% in February, as we and the Fed had been expecting for some time.

Figure 2: Core services CPI showing signs of levelling off

Source: Bureau of Labor Statistics, May 2023

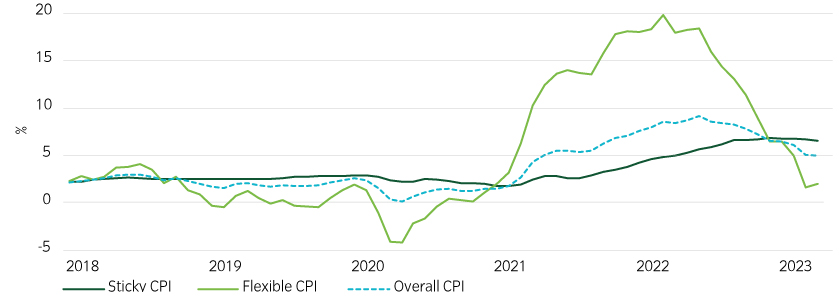

Core goods accelerated for the first time since March 2022, driven by a rebound in used cars prices, which snapped nine months of declining prices. However, outside of used vehicles, core goods generally continued their disinflationary trend.

Figure 3: Used cars drive an uptick in "flexible" goods categories

Source: Atlanta Fed, Bureau of Labor Statistics, May 2023

Elsewhere, energy prices picked-up slightly month-on-month (having been the largest negative index contributor last month) despite global oil prices rebounding in the first half of April after surprise production cuts from OPEC.

Base effects may help inflation fall further this summer

CPI peaked last summer, reaching 9% year-on-year last June. This indicates base effects could potentially help push CPI closer to, or even into, the ~3% to ~4% range.

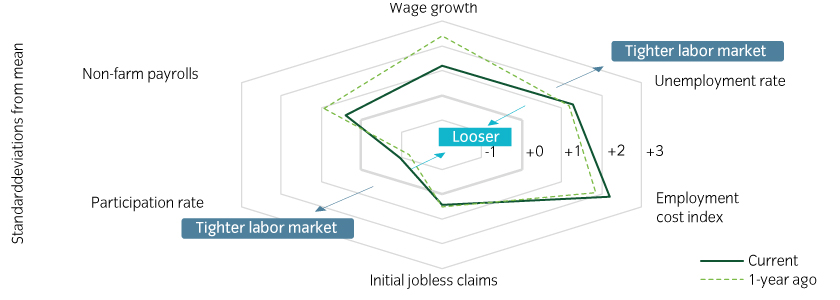

However, further gains toward the Fed’s 2% target will be difficult as the same base effects will fizzle out toward the end of the year. Ultimately, we believe the Fed will need to see a further loosening of the labor market to see the full extent of progress it wants. While some labor market indicators are encouraging (like wage growth) others remain historically tight (Figure 4).

Figure 4: The labor market is loosening, but not yet in all respects

Source: Bureau of Labor Statistics, Department of Labor, Insight calculations (standard deviations relative to long-term mean) (wage growth = average hourly earnings), May 2023

The Fed will likely stay on hold for now, but CPI continues to move in the right direction

Today’s print offers encouraging signs of a slowdown in core services inflation, particularly rents and the “supercore” measure. However, given the “stickiness” of these categories, we expect further progress to be protracted and the Fed will likely maintain rates at current levels.

United States

United States